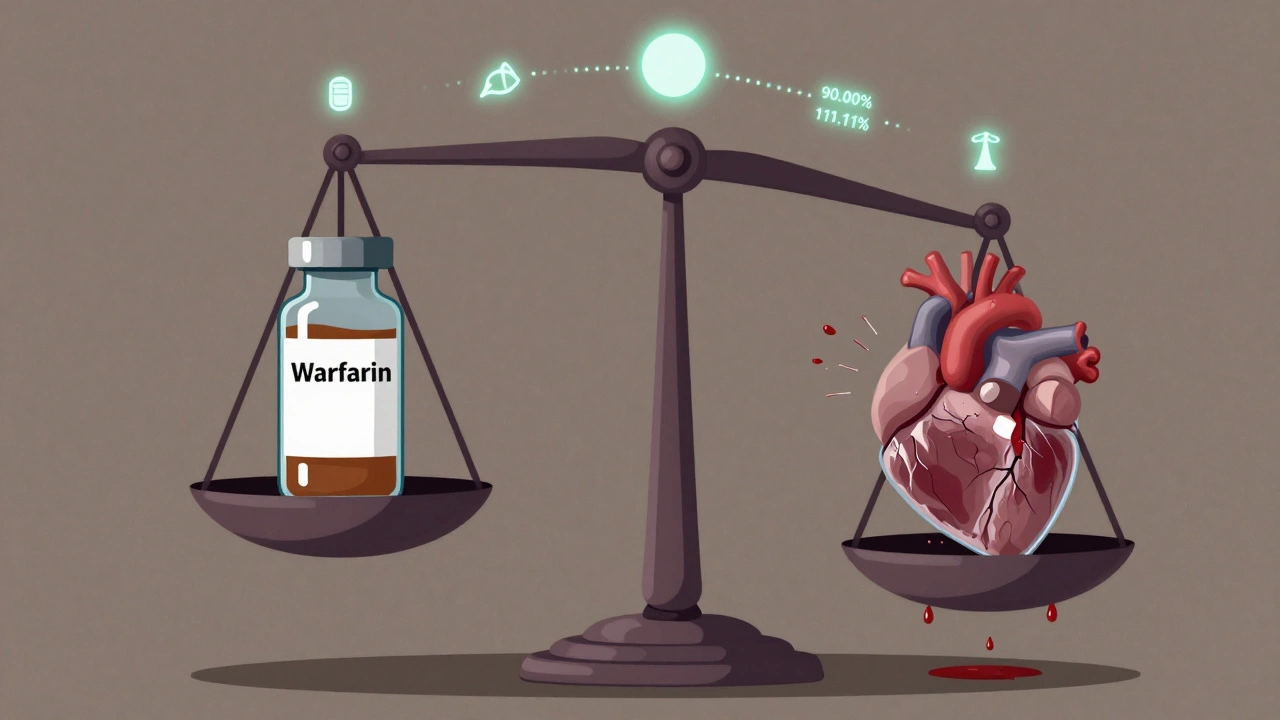

When a drug has a narrow therapeutic index (NTI), even tiny differences in how it’s absorbed by the body can mean the difference between healing and harm. These are not ordinary medications. Think warfarin, phenytoin, digoxin, or levothyroxine - drugs where the dose that works is barely below the dose that can cause serious side effects or even death. That’s why generic versions of NTI drugs don’t get approved the same way as regular generics. They need something extra: bridging studies.

Why NTI Generics Can’t Skip the Extra Steps

For most generic drugs, regulators accept a standard bioequivalence study: compare the brand-name drug to the generic in healthy volunteers, measure blood levels over time, and check if the generic delivers the same amount of drug within an 80%-125% range. That’s it. But for NTI drugs, that range is too wide. A 20% difference in absorption could push a patient from safe to toxic. So regulators tightened the rules. The U.S. Food and Drug Administration (FDA) now requires a 90.00%-111.11% confidence interval for both Cmax (peak concentration) and AUC (total exposure) for NTI generics. That’s a much narrower window. It’s not just about being "close enough." It’s about being nearly identical. The same applies to the quality of the drug substance - assay limits are now 95%-105%, not the 90%-110% allowed for non-NTI drugs. This isn’t arbitrary. The FDA defines NTI drugs using five criteria: a maximum two-fold difference between the minimum effective and minimum toxic dose, low within-subject variability (under 30%), the need for routine blood monitoring, small dose adjustments (often less than 20%), and a therapeutic index of 3 or less. Drugs that meet these are treated as high-risk from the start.The Study Design That Makes NTI Generics So Hard to Make

Standard bioequivalence studies use a two-way crossover - each participant takes the brand and the generic once, in random order. Simple. Efficient. For NTI generics, that’s not enough. The FDA requires a four-way, fully replicated crossover design. That means each volunteer takes the brand drug twice and the generic drug twice, in different sequences. Why? To get a clear picture of how much the drug varies from person to person and from dose to dose. This design lets regulators use a method called reference-scaled average bioequivalence (RSABE). It accounts for natural variability in how people absorb NTI drugs. Without it, you might reject a perfectly safe generic just because one person’s blood levels fluctuated more than average. RSABE lets you focus on whether the generic behaves like the brand - not whether every single person’s numbers match perfectly. But this complexity comes at a cost. A typical NTI bridging study needs 40-60 participants, compared to 24-36 for standard generics. Each participant spends 4-6 weeks in the clinic, with multiple blood draws over several days. That means longer timelines, higher dropout rates, and a study that costs $2.5-$3.5 million - 30-50% more than a standard bioequivalence trial.Why Only 6% of Generic Approvals Are NTI Drugs

Despite NTI drugs making up about 14% of all small-molecule medications, only 6% of generic approvals between 2018 and 2022 were for NTI products. Why? Because the hurdles are real. A 2022 survey by the Generic Pharmaceutical Association found that 78% of manufacturers consider NTI drug development "significantly more challenging" than standard generics. The biggest reason? The bridging study requirements. Sixty-three percent said the complex study design was the main barrier. One company’s senior regulatory director noted that the four-period design increases study duration by 40-50% and requires double the number of subjects. The FDA’s data backs this up. Between 2018 and 2022, 37% of complete response letters for NTI generics cited inadequate bridging study design as the primary reason for rejection. For non-NTI generics, that number was just 12%. Many companies simply don’t have the internal expertise. Only 35% of generic manufacturers have in-house pharmacokinetic specialists trained in RSABE analysis. It takes 18-24 months for a company to build that capability from scratch.

Market Reality: Low Penetration, Big Opportunity

The global market for NTI drugs was worth $78.5 billion in 2022 and is expected to grow at 5.2% annually through 2028. Yet, generic penetration for these drugs is only 42%. For non-NTI drugs, it’s 85%. That gap represents a $32.8 billion opportunity by 2025. Patients are paying more than they should. Brand-name warfarin or levothyroxine can cost hundreds of dollars a month. Generic versions, if available, are cheaper - but they’re not always available. When they are, some prescribers still hesitate. They worry about switching patients from one generic to another, or from brand to generic, because of past concerns about variability. But those concerns often come from older studies or poorly designed generics that didn’t meet today’s standards. The FDA’s updated guidance in March 2023 expanded the list of NTI drugs requiring strict bioequivalence testing from 12 to 27. That means more products will be held to the same high bar. And that’s good news for patients - it ensures that when a generic is approved, it’s as safe and effective as the brand.What’s Changing in the Future

Regulators aren’t standing still. The FDA has a pilot program for complex generics, including NTI drugs, that has cut review times by 25% for participants. Pre-ANDA meetings - where companies talk to the FDA before submitting their application - are now used by 82% of NTI applicants. Ninety percent say these meetings save time and money. New tools are emerging. Physiologically-based pharmacokinetic (PBPK) modeling - computer simulations that predict how a drug behaves in the body based on its chemical properties and human physiology - is being tested as a possible alternative to some clinical bridging studies. In a 2022 pilot study, PBPK modeling successfully predicted bioequivalence for warfarin generics. The FDA says it’s promising, but still too early to replace clinical data entirely. The European Medicines Agency and the International Council for Harmonisation (ICH) are working on global alignment. By 2025, there may be a unified definition of NTI drugs and a shared approach to bridging studies. That could make it easier for manufacturers to develop products for multiple markets without redoing studies.

kevin moranga

December 11, 2025 AT 21:26Man, I just read this whole thing and I’m genuinely impressed. NTI drugs are one of those areas where cutting corners isn’t just risky-it’s literally life-or-death. The fact that regulators require such tight bioequivalence ranges? That’s not bureaucracy, that’s compassion in action. I’ve seen patients on warfarin who can’t afford brand names, and when generics finally meet these standards, it’s a win for everyone. We need more of this rigor, not less.

Lara Tobin

December 13, 2025 AT 16:50This gave me actual chills. 😭 So many people don’t realize how much science and care goes into these ‘simple’ generics. Thank you for explaining it so clearly. I have a friend on levothyroxine and I never knew how much was at stake. This is healthcare done right.

Emma Sbarge

December 13, 2025 AT 18:24Let’s be real-this isn’t about safety. It’s about Big Pharma protecting their profits under the guise of ‘patient care.’ The FDA’s 90–111% range? That’s still wide enough for a drug to behave wildly differently. And don’t get me started on how they cherry-pick which drugs are NTI. This system is rigged.

Jamie Clark

December 15, 2025 AT 02:00So we’re spending millions to make generics that are ‘nearly identical’? What’s the point? If the brand drug works, why not just let people pay for it? This whole system is a monument to overengineering. We’re not curing cancer here-we’re just tweaking blood levels. The cost of these studies could fund ten times as many actual medical interventions. Priorities, people.

Himmat Singh

December 15, 2025 AT 02:27While the regulatory framework is commendable, one must question the empirical validity of the 90.00%-111.11% confidence interval as a universal metric. Biological variability is not linear, nor is pharmacokinetic absorption. The assumption that narrow intervals equate to clinical equivalence is a statistical fallacy, particularly when inter-individual variability exceeds 30%. The FDA’s criteria, though well-intentioned, lack epistemological grounding in dynamic physiological systems.

Casey Mellish

December 15, 2025 AT 10:51As an Aussie who’s seen our TGA adopt similar standards, I can say this: the US isn’t alone in being cautious. But here’s the kicker-we’re starting to use PBPK modeling in real-world submissions now. It’s not sci-fi anymore. In fact, a couple of Aussie-made NTI generics passed approval last year using simulated data. The future’s here, folks. We just need to stop treating clinical trials like the only holy grail.

Tyrone Marshall

December 15, 2025 AT 11:28I’ve been in this game for 20 years. I’ve seen generics get approved, then pulled off the market because someone’s INR spiked. That’s why we do this. It’s not about cost. It’s about not killing someone because we wanted to save $2. This isn’t a debate-it’s a moral obligation. If you think this is too expensive, try explaining to a family why their mom had a stroke because her generic wasn’t actually equivalent.

Emily Haworth

December 16, 2025 AT 22:38EVERYONE knows the FDA is in bed with Big Pharma. 🤫 These ‘bridging studies’? Total scam. The real reason generics are rare is because the FDA won’t let them compete. They’re paid off. Look at the timeline-37% rejection rate? That’s not science, that’s suppression. And PBPK modeling? That’s just the next lie. They don’t want cheap meds. They want you dependent. 🕵️♀️💊

Lauren Scrima

December 18, 2025 AT 01:09So… we spend $3M, wait 2 years, and get a pill that’s… 95% the same? 🤔 And we call this progress? I mean, sure, I don’t want to die, but… are we really sure this isn’t just overkill dressed up as science? Like… can’t we just monitor INR like we always have?

Richard Ayres

December 19, 2025 AT 12:38This is one of the most balanced, thoughtful pieces I’ve read on pharmaceutical regulation in years. The tension between access and safety is real, and you’ve laid out the trade-offs with nuance. The fact that only 6% of generics are NTI isn’t a failure-it’s a testament to the system’s integrity. We should be proud that we demand more from drugs that can kill you if they’re off by a fraction. Let’s not rush to ‘simplify’ what needs to be complex.

Shelby Ume

December 20, 2025 AT 08:12As someone who works in clinical pharmacy, I see patients switch between generics all the time-and yes, sometimes there’s a tweak needed. But here’s the thing: the ones that pass these bridging studies? They’re stable. The problem isn’t the generics-it’s the lack of provider education. We need to teach docs that if it’s FDA-approved under NTI rules, it’s safe. No more fear-mongering. Let’s stop blaming the pill and start blaming the misinformation.

Tom Zerkoff

December 22, 2025 AT 07:26The four-period crossover design is non-negotiable. I’ve reviewed hundreds of ANDAs. The ones that skip proper replication? They fail. Every time. And when they make it through? Patients get hurt. I’ve seen it. The $3 million cost? It’s a drop in the bucket compared to the cost of a hospitalization from a toxic dose. This isn’t about profit-it’s about preventing avoidable deaths. If you’re complaining about the cost, you’re not thinking about the human cost.

Yatendra S

December 22, 2025 AT 22:50What if the real NTI isn’t the drug… but the system? We treat patients like data points. We measure blood levels like a machine. But what about the person? The anxiety? The cost? The fear of switching? Maybe we’re optimizing for the wrong thing. Maybe safety isn’t just in the math… it’s in the trust.

Scott Butler

December 23, 2025 AT 18:09Only 6%? Pathetic. This is why America’s healthcare is broken. We’re letting foreign manufacturers dominate the market because our own companies can’t handle the paperwork. If we had real manufacturing here, we’d have these generics in a heartbeat. Stop over-regulating and start making things again.