By 2025, legal changes aren’t just coming-they’re already here. From how you pay your employees to what you can build in California, the rules are shifting faster than ever. If you’re running a business, managing a team, or even just filing your taxes, you need to know what’s changing and why it matters. This isn’t about theoretical law-it’s about real, actionable shifts that affect your wallet, your workplace, and your rights.

Employment Laws Are Getting More Complex-Especially in California

California’s labor laws are now the most aggressive in the country. Starting October 1, 2025, Assembly Bill 406 merged two separate leave laws into one: the Fair Employment and Housing Act (FEHA). That means if you’re an employer in California, you can’t just rely on old HR manuals. You need to update your notice templates, train managers, and revise your paid sick leave policy. The law now clearly defines who qualifies for leave when a family member is a victim of violence or abuse. It also expands the definition of “family member” to include anyone with a close personal relationship-even if they’re not related by blood.Senate Bill 642 changed pay transparency rules. Employers now must include pay ranges in every job posting, even for remote roles if the employee could work from California. Violations can cost up to $10,000 per violation. And don’t think you can ignore it if you’re based out of state-if even one employee works remotely from California, you’re covered.

By July 1, 2028, Senate Bill 590 will let workers take paid family leave to care for a “designated person.” That could be a close friend, roommate, or partner who isn’t legally related. This isn’t just about fairness-it’s about recognizing how people actually live today. But here’s the catch: you’ll need to train your HR team to handle these requests without asking invasive questions about relationships.

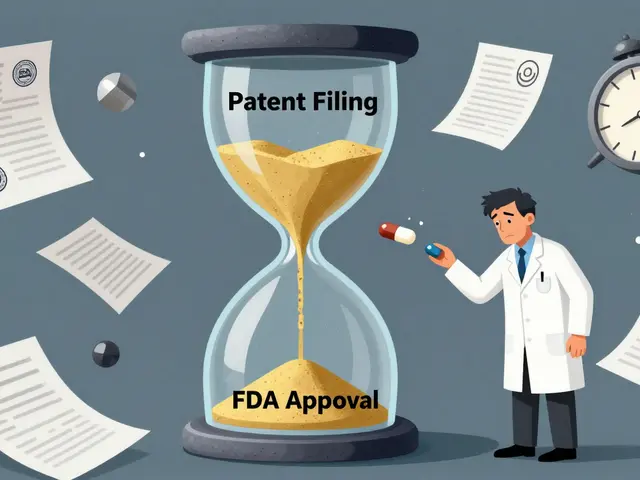

The Federal Tax Law Just Got a Major Overhaul

The “One, Big, Beautiful Bill” (Public Law 119-21), signed on July 4, 2025, brought the biggest tax change in a decade. The most visible update? A $6,000 deduction for anyone 65 or older, effective through 2028. That’s not a credit-it’s a deduction. So if you’re filing your 2025 taxes, you can reduce your taxable income by $6,000 if you’re eligible. The IRS released guidance in IR-2025-107, clarifying how to claim it on Form 1040.But the biggest surprise was the reversal on Form 1099-K. After years of pushing to lower the reporting threshold to $600, the IRS went back to $20,000. That means if you sold goods online and made $15,000 this year, you won’t get a 1099-K. This was a win for small sellers, gig workers, and side hustlers who were drowning in paperwork.

There’s also a new focus on Employee Retention Credits (ERC). The IRS issued FS-2025-07 to crack down on fraudulent claims. If you got an ERC between 2020 and 2023, you’re now being audited more closely. Many small businesses are scrambling to gather payroll records, bank statements, and proof of shutdowns to prove they qualified.

California’s Housing Laws Are Changing the Construction Game

If you’ve ever tried to build a house in California, you know the process takes forever. Assembly Bill 130 and Senate Bill 131 changed that. These bills, part of the 2025-2026 state budget, gutted major parts of the California Environmental Quality Act (CEQA) for housing and infrastructure projects. Developers no longer need to do full environmental reviews for projects near public transit, affordable housing zones, or infill sites.That’s not a loophole-it’s intentional policy. The state estimates this will cut approval times by 18 to 24 months. The California Building Industry Association says this could add 15-20% more housing units per year. That’s over 100,000 new homes by 2030. But it’s not without controversy. Some environmental groups argue it weakens protections for wetlands and endangered species. Local governments now have to balance speed with accountability, and many are hiring new compliance officers just to handle the new rules.

Firearms Rules Are Expanding-And So Are Legal Gray Areas

The LEOSA Reform Act of 2025 (H.R.2243) passed the House in May and is now in the Senate. If it becomes law, qualified retired and active law enforcement officers can carry concealed weapons in places they couldn’t before: school zones, national parks, and even private property open to the public. States can still set their own rules, but they can’t ban it outright. The bill also lets states reduce how often retired officers must requalify with their firearms-from annually to every five years.This isn’t just about guns. It’s about jurisdictional conflict. If a retired officer from Texas carries in California, which rules apply? The federal law overrides state bans, but local police still have discretion in enforcement. That creates confusion on the ground. Many police departments are already updating training manuals to handle these situations.

The Supreme Court Is Shaping the Future of American Law

The Roberts Court turns 20 in 2025. And this term, it’s taking on the biggest constitutional questions in decades. Experts predict rulings that will expand presidential power, limit voting rights, and weaken federal agency authority. One case, currently under review, could redefine what “executive privilege” means-potentially letting presidents hide more information from Congress and the courts.Legal teams at Fortune 500 companies are already hiring constitutional lawyers at a 25% higher rate than last year. Why? Because if the Court rules against federal agencies, it could wipe out entire regulatory frameworks-from environmental protections to workplace safety rules. Companies can’t wait to see what happens. They’re building contingency plans now.

Compliance Is No Longer a Department-It’s a Company-Wide System

You can’t just assign compliance to HR or legal anymore. With so many moving parts-state laws, federal changes, court rulings, tax updates-organizations are forced to treat regulation like a live feed. RegEd’s 2025 report found that companies spending over $1 million on compliance software saw a 30% drop in violations. Those using AI-powered tools to track rule changes in real time cut response time from weeks to hours.California employers report spending $1,200 to $1,800 per employee on training for AB 406. That’s not a one-time cost-it’s an ongoing investment. The same goes for tax professionals. The American Institute of Professional Bookkeepers saw a 40% jump in enrollment for 2025 tax courses. This isn’t about checking boxes. It’s about survival.

What’s Coming Next in 2026?

The IRS will release 2026 tax inflation adjustments in late 2025, including updates tied to the “One, Big, Beautiful Bill.” Expect changes to standard deductions, retirement contribution limits, and income thresholds for tax brackets.More states are following California’s lead. In 2025, 37 out of 50 states passed at least one major employment law change, according to the National Conference of State Legislatures. Look for paid leave expansions, wage theft protections, and remote work rules to spread.

RegTech is booming. Gartner predicts a 35% rise in regulatory software sales in 2025. Deloitte says 78% of Fortune 500 companies will have AI systems scanning for new laws by 2026. If you’re not using any kind of automated tracking tool, you’re already behind.

And don’t forget the pending bills. One proposal would restore free phone calls for detainees to talk to lawyers and family. Another would limit how long companies can keep employee data. These may seem small, but they’re signs of a larger trend: the law is catching up to how we live, work, and connect.

What Should You Do Now?

- Review your HR policies-especially if you have California employees.

- Check your tax preparation software for 2025 updates-especially if you’re over 65 or run a side business.

- Ask your legal team: “What court cases could change our business model?”

- Start tracking state-specific laws-even if you don’t operate there yet. Remote work means you’re subject to rules wherever your employees live.

- Invest in a regulatory monitoring tool. Even a basic subscription can save you thousands in fines.

The law isn’t slowing down. It’s accelerating. And the only way to keep up is to act before the change hits you-not after.

Do I need to update my employee handbook because of AB 406?

Yes. AB 406 merged victims’ leave provisions into the FEHA, so your handbook must reflect the new definitions of family members and leave eligibility. You also need to update your notice templates. The California Civil Rights Department will release a new model notice by November 2025. Employers who don’t update risk fines up to $10,000 per violation.

Will the $6,000 tax deduction apply to me if I’m 64?

No. The deduction only applies to individuals who are 65 or older by the end of the tax year. If you turn 65 in December 2025, you qualify for the 2025 tax return. But if you’re still 64 on December 31, 2025, you’ll have to wait until 2026 to claim it.

Can I still be sued under CEQA if I build in California under the new law?

Yes, but only in limited cases. The new exemptions apply only to housing and infrastructure projects near transit, in high-density zones, or on infill sites. Projects involving wetlands, endangered species habitats, or historic districts still require full CEQA reviews. You can’t bypass environmental review entirely-you just need to know which rules still apply.

What happens if I don’t update my Form 1099-K reporting threshold?

The IRS reverted the threshold to $20,000, so you’re no longer required to issue 1099-Ks for payments under that amount. If you keep reporting lower thresholds out of habit, you may accidentally send unnecessary forms to freelancers or small sellers. That could trigger confusion, audits, or even penalties for incorrect filings. Stick to the new $20,000 rule.

Are retired police officers really allowed to carry guns in schools now?

Yes-if they’re qualified under LEOSA and meet federal standards. The law allows them to carry concealed weapons in school zones, even if state or local law bans it. But schools can still require them to notify administrators or follow specific procedures. The law doesn’t override all rules-it just prevents outright bans.

Tiffany Fox

November 28, 2025 AT 06:28AB 406 is a game-changer for small employers. I updated our handbook last week and had to retrain all managers. The new 'close personal relationship' definition caught everyone off guard-turns out our HR intern qualifies as a designated family member for leave. No blood required, just mutual support. Weird? Maybe. Real? Absolutely.

Rohini Paul

November 28, 2025 AT 19:32Love that California’s leading this stuff. In India, we’re still arguing if remote work counts as employment. But this? Paid leave for your roommate who held your hair back during chemo? That’s humanity in policy form. 🙌

Courtney Mintenko

November 30, 2025 AT 15:38So we’re now legally recognizing emotional labor as family? Next they’ll make you pay your therapist in holiday bonuses. The whole thing’s a performance. We’re not fixing systems-we’re just adding more boxes to check. 😒

Sean Goss

December 1, 2025 AT 13:13The CEQA exemptions are a regulatory arbitrage play disguised as housing policy. You’re not streamlining compliance-you’re externalizing environmental externalities. The 18–24 month reduction is statistically dubious without longitudinal impact studies. And the BIA’s 15–20% projection? Baseless extrapolation from pre-pandemic data. 📉

Khamaile Shakeer

December 1, 2025 AT 22:14LEOSA Reform? 😅 So now retired cops can carry in schools… but only if they don’t trigger the ‘no firearms’ sign? Cool. So the law says one thing, the cops say another, and the principal just sighs and pretends it’s not happening. Classic. 🤷♂️🔫

Suryakant Godale

December 2, 2025 AT 19:50While the legislative developments outlined are indeed significant, one must consider the procedural integrity of implementation. The expansion of designated persons under SB 590, while socially progressive, necessitates robust internal documentation protocols to prevent potential abuse of leave entitlements. Furthermore, the IRS’s reinstatement of the $20,000 1099-K threshold aligns with fiscal pragmatism, though administrative clarity remains paramount.

ka modesto

December 4, 2025 AT 13:15For anyone stressing about the $6,000 tax deduction-yes, you qualify if you turn 65 anytime in 2025. Just make sure your birth date is correctly entered in your tax software. I helped three clients last week get it right. Easy win if you’re eligible.

Cindy Burgess

December 5, 2025 AT 12:29It is regrettable that the erosion of CEQA protections is being rationalized under the banner of housing equity. The precedent set by these amendments undermines decades of environmental jurisprudence. One cannot simultaneously advocate for sustainable development and legislate away its foundational safeguards.

Tressie Mitchell

December 5, 2025 AT 18:31Of course the ‘One, Big, Beautiful Bill’ is a marketing gimmick. Real tax reform doesn’t come with a hashtag. This is performative governance for the middle class while the rich get offshore loopholes. The $6,000 deduction? A candy wrapper on a dumpster fire.

dayana rincon

December 7, 2025 AT 09:57So the IRS went back to $20k on 1099-Ks? Honestly? 🙏 Thank you, whoever was listening. I sold 12k worth of vintage tees on Etsy this year and didn’t get a single form. I’m not crying-I’m just quietly celebrating with a margarita. 🥂

Orion Rentals

December 7, 2025 AT 11:27While the legislative landscape has evolved significantly, it is imperative that organizations adopt a holistic compliance framework. The convergence of state, federal, and judicial developments necessitates a centralized, audit-ready infrastructure. Proactive alignment with RegTech solutions is not merely advisable-it is a fiduciary responsibility.