When it comes to saving money on high-cost biologic drugs, biosimilars are the quiet revolution happening right now. These aren’t generics. They’re not copies like the pills you get for blood pressure or cholesterol. Biosimilars are near-identical versions of complex, living-cell-based medicines-drugs like Humira, Enbrel, or Remicade-that treat everything from rheumatoid arthritis to cancer. And while both Europe and the United States have them, the two markets couldn’t be more different in how they got here-and where they’re headed.

Europe Got There First

Europe didn’t just lead the way-it built the playbook. In 2006, the European Medicines Agency (EMA) approved the world’s first biosimilar, Omnitrope, a version of the growth hormone somatropin. That wasn’t an accident. The EMA had spent years creating a clear, science-based pathway: prove the biosimilar is highly similar through rigorous lab tests, animal studies, and a few targeted human trials. No need for massive, expensive clinical trials repeating everything the original drug did. Just enough to show there’s no meaningful difference in safety or effectiveness.

That clarity changed everything. Hospitals in Germany, France, and the UK started using biosimilars in bulk. Tenders, where healthcare systems bid for the lowest price, became routine. By 2024, Europe’s biosimilar market hit $13.16 billion, according to Precedence Research. In some countries, biosimilars make up over 80% of the market for key biologics in rheumatology and oncology. Doctors trust them. Pharmacists substitute them without hesitation. Patients don’t even notice the switch.

Germany became the manufacturing hub. Companies like Sandoz, Fresenius Kabi, and Amgen built production facilities there because the rules were stable, the demand was predictable, and the government backed the shift. It wasn’t just about cost-it was about system-wide confidence.

The U.S. Started Late-and Got Stuck

The United States passed the Biologics Price Competition and Innovation Act (BPCIA) in 2009, six years after Europe. But approval didn’t mean adoption. The first U.S. biosimilar, Zarxio (a version of filgrastim), didn’t hit the market until 2015. And even then, sales were slow.

Why? Patent thickets. Originator companies like AbbVie (maker of Humira) used legal tactics to delay competition. The “patent dance”-a complicated, often adversarial process under the BPCIA-gave drugmakers years of extra protection. By 2024, 14 Humira biosimilars had been approved in the U.S., but only six were actually on the market. The rest were stuck in legal limbo.

Doctors were skeptical. Payers didn’t push hard. Patients didn’t know what biosimilars were. The FDA required extra clinical studies just to label a biosimilar as “interchangeable”-meaning a pharmacist could swap it for the original without asking the doctor. That requirement alone held back adoption for nearly a decade.

The Turning Point: June 2024

Everything changed in June 2024. The FDA dropped the requirement for switching studies to get interchangeable status. That’s huge. Those studies forced manufacturers to test whether patients could safely switch back and forth between the original drug and the biosimilar-something Europe never required. The FDA admitted it was unnecessary. The science already showed biosimilars were safe. Why force more trials?

That one move unlocked the door. Suddenly, companies like Pfizer, Merck, and Samsung Bioepis had a clear path to launch interchangeable biosimilars for blockbuster drugs like Humira, Enbrel, and Herceptin. By early 2026, more than 20 biosimilars had been approved in the U.S., up from just 12 in 2024. And the market? It hit $10.9 billion in 2024, according to Alira Health, and is projected to hit $30.2 billion by 2033.

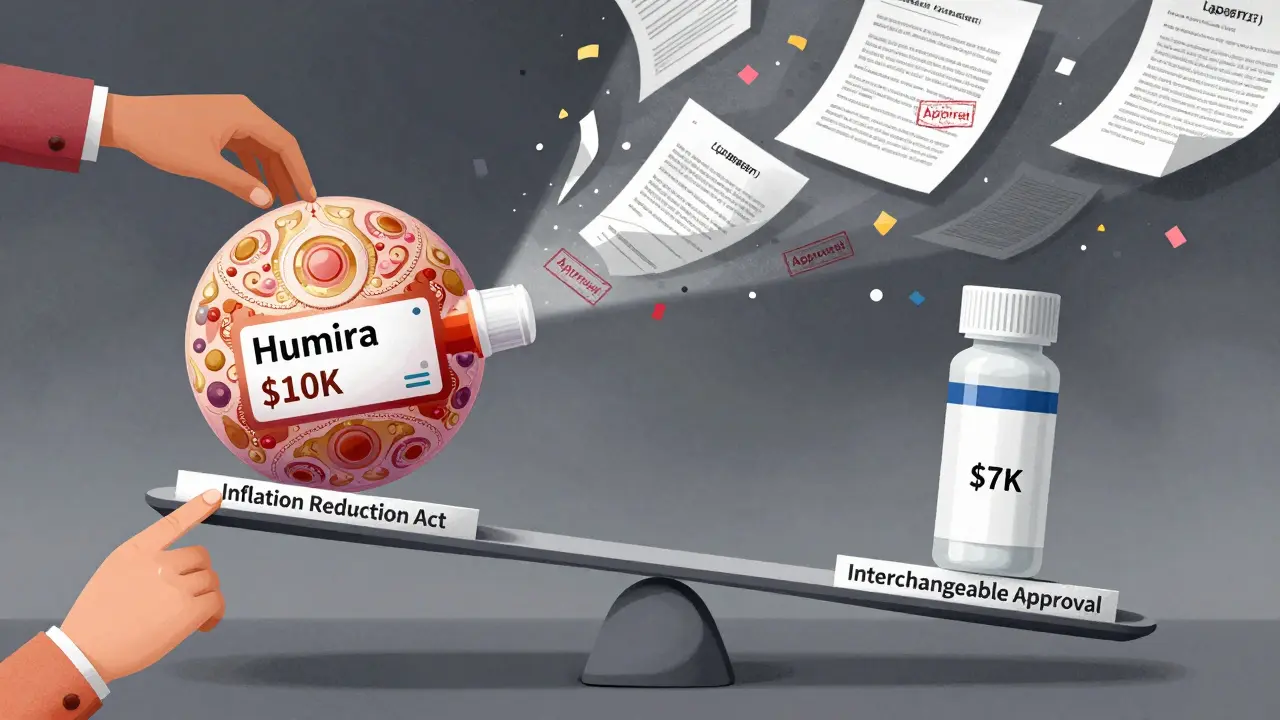

The Inflation Reduction Act of 2022 helped too. By closing the Medicare Part D coverage gap-the “donut hole”-it made biosimilars more attractive to insurers. Why pay $10,000 for a biologic when a biosimilar costs $7,000 and the patient pays the same out-of-pocket?

Market Size and Growth: Who’s Ahead?

Right now, Europe still leads in total revenue. But the U.S. is catching up fast. Europe’s market grew at 13% annually from 2020 to 2024. The U.S. grew at 11% in the same period. But projections show the U.S. will outpace Europe in growth rate over the next decade-18.5% vs. 17.3%-because it’s starting from a lower base.

By 2027, North America (mostly the U.S.) is expected to overtake Europe as the largest biosimilar market by revenue, according to Grand View Research. Why? Because the U.S. has more high-revenue biologics coming off patent. IQVIA estimates 118 biologics will lose exclusivity between 2025 and 2034, worth $232 billion in sales. Europe’s biggest biologics already have biosimilars in place. The U.S. is just getting started.

Therapeutic Areas: Where They’re Used

Europe’s strength? Autoimmune diseases. Biosimilars for TNF inhibitors like adalimumab and infliximab dominate in rheumatology and inflammatory bowel disease. Oncology is strong too.

The U.S. started with supportive care drugs-like filgrastim (used to boost white blood cells after chemo). These were simpler, less controversial, and easier to get approved. Now, the focus is shifting to the big-ticket items: cancer drugs, diabetes treatments, and rare disease therapies. The Humira biosimilar wave is just the beginning.

Who’s Making Them?

In Europe, Sandoz, Fresenius Kabi, and Amgen are the giants. In the U.S., Pfizer and Merck are leading the charge, with Samsung Bioepis playing a major role in both markets. The manufacturing landscape is global now. A biosimilar made in South Korea might be sold in Germany, then approved in the U.S. under the same data package. Regulatory harmonization is real-both agencies now accept similar analytical and non-clinical data. The gap is narrowing.

What’s Next?

The next frontier? Complex biosimilars. Drugs with multiple components, like antibody-drug conjugates or long-acting biologics. These are harder to replicate. But the science is improving. And the financial pressure is mounting. Biologics account for nearly half of all U.S. drug spending, even though they’re used by only 2% of patients. Biosimilars are the only real tool we have to bring those costs down.

Europe proved it’s possible. The U.S. is learning from that. The regulatory roadblocks are falling. The patents are expiring. And the money is too big to ignore.

By 2035, the global biosimilar market could hit $72 billion, according to MarketsandMarkets. That’s not just a market shift-it’s a healthcare transformation. And it’s happening faster than most people realize.

Are biosimilars the same as generics?

No. Generics are exact chemical copies of small-molecule drugs, like aspirin or metformin. Biosimilars are copies of large, complex proteins made from living cells. They’re highly similar, but not identical. Think of it like a handcrafted replica of a painting-same brushstrokes, same colors, but made by a different artist. The FDA and EMA require extensive testing to prove they work the same way in the body.

Why are biosimilars cheaper than the original biologics?

Because they don’t need to repeat all the early-stage research. The original drug company spent billions on discovery, animal testing, and large clinical trials to prove safety and effectiveness. Biosimilar makers can use that data to prove similarity without starting from scratch. That cuts development costs by 50-70%. They still need to run some clinical trials, but far fewer. The savings get passed on-biosimilars typically launch at 15-30% lower prices than the original.

Can pharmacists switch me to a biosimilar without my doctor’s approval?

In Europe, yes-in many countries, substitution is automatic and allowed by law. In the U.S., only if the biosimilar is designated as “interchangeable” by the FDA. Before June 2024, very few were. Now, more are being approved with that status, and pharmacists can swap them without asking your doctor. But it still depends on your state’s laws and your insurance plan.

Is there any risk in switching from a biologic to a biosimilar?

No clinically meaningful risk. Hundreds of thousands of patients have switched. Studies show no difference in safety, effectiveness, or side effects. The FDA and EMA require proof of similarity before approval. If a biosimilar were unsafe, it wouldn’t be approved. The fear of switching is mostly based on misunderstanding-not science.

Why did it take the U.S. so long to catch up to Europe?

Three things: legal barriers, lack of reimbursement incentives, and physician hesitation. Patent lawsuits delayed entry. Insurers didn’t push biosimilars hard because they didn’t have financial reasons to. And doctors weren’t educated-many thought biosimilars were “inferior.” Europe solved these early with clear rules, mandatory substitution, and strong communication. The U.S. is catching up now, thanks to regulatory changes and the Inflation Reduction Act.

Will biosimilars replace biologics completely?

Not completely, but they’ll dominate. In Europe, biosimilars already make up over 80% of the market for some drugs. In the U.S., that’s coming. Biologics will still be used-especially for patients who’ve been on them for years or have rare conditions. But for new patients, biosimilars will be the default. The cost difference is too big to ignore.

Donna Macaranas

February 2, 2026 AT 10:28Finally someone talks about this without jargon. I switched my mom to a biosimilar for her RA last year and she didn’t even notice. Her co-pay dropped from $120 to $35. No side effects, no drama. Why is this still a debate?

Rachel Liew

February 2, 2026 AT 11:55im so glad this is getting attention!! i work in a clinic and patients are scared to switch but once we explain it like ‘same medicine, different brand’ they’re like ohhh okay. no one should pay $10k for a shot when $7k works just as good. 💛

Lisa Rodriguez

February 4, 2026 AT 08:23Europe’s model is the blueprint and it’s not even close. They made substitution automatic, educated providers, and didn’t let Big Pharma delay everything with lawsuits. The FDA finally got it right in June 2024 but why did it take 15 years? We had the science. We just lacked the political will.

Now that interchangeable status is easier to get, we’re going to see prices crash. Humira biosimilars alone could save the system $15B a year. That’s not just smart-it’s moral. People are dying because they can’t afford treatment. This fixes that.

And yes, they’re not generics. But they’re not magic either. They’re science. And science doesn’t need to be feared. It needs to be used.

Lilliana Lowe

February 5, 2026 AT 14:50It’s amusing how Americans act like they discovered biosimilars in 2024. The EMA established regulatory standards in 2005. The FDA’s ‘interchangeability’ requirement was never scientifically justified-it was a political concession to lobbyists. The fact that it took 15 years to admit that is a testament to how broken our regulatory capture system is.

Also, ‘manufacturing hub in Germany’? That’s not a coincidence. The EU doesn’t let corporations dictate pricing. We do. And until we fix that, we’re just rearranging deck chairs on the Titanic.

vivian papadatu

February 6, 2026 AT 14:13Just saw this article and had to share with my sister who’s on Humira. She’s been scared to switch for years. Now she’s going to ask her doctor about the new interchangeable ones. This is huge. 🌍

Also-huge shoutout to Sandoz and Samsung Bioepis. They’re doing the heavy lifting. And the Inflation Reduction Act? Quietly revolutionary. Not flashy, but it saved lives. 💪

Melissa Melville

February 8, 2026 AT 01:23So Europe’s been doing this for 18 years and we’re just now catching up because… the FDA got bored? 😂

Deep Rank

February 8, 2026 AT 12:08you all are so naive. biosimilars are just a trick by pharma to keep profits while pretending to lower costs. theyre not identical. the body reacts differently. just look at the lawsuits. the FDA is corrupted. they approve these things because they get paid. i read a paper once that said 78% of FDA reviewers have pharma ties. this is all a scam. your mom might feel fine now but wait till she gets cancer from the impurities. its not science its corporate control. they want you dependent on cheap drugs so you dont question the system. trust me i know. i’ve seen it. the data is buried. the truth is hidden. dont be fooled.

Naomi Walsh

February 9, 2026 AT 04:53Let’s be clear: the U.S. regulatory environment is still a joke. The FDA’s ‘interchangeability’ standard was never about science-it was about appeasing patent trolls. Europe’s EMA operates on evidence. America operates on litigation. The fact that we needed a law to force the FDA to stop wasting taxpayer money on unnecessary trials says everything about our healthcare system’s dysfunction.

And don’t get me started on the ‘patent dance.’ It’s not a dance. It’s a legal extortion racket. And we’re the ones paying for it.

Bob Cohen

February 10, 2026 AT 23:37Yeah but let’s be real-most docs still don’t know how to explain biosimilars to patients. I’ve had people refuse them because they think it’s ‘the cheap version.’ Like, no, it’s the scientifically validated version. The real tragedy isn’t the delay-it’s the misinformation. We need a public education campaign, not just regulatory tweaks.

Aditya Gupta

February 12, 2026 AT 03:50India’s making biosimilars too. Cheap, good, global. We export to Africa, LatAm, even Europe. US just woke up. But hey, better late than never 😊

Jaden Green

February 13, 2026 AT 09:39Let’s not pretend this is a win. The FDA only changed because the cost of inaction became politically embarrassing. The real story is that we spent $200 billion on biologics over the last decade because we let lawyers and lobbyists dictate medical policy. Now that patents are expiring, suddenly it’s ‘innovation.’ No-it’s just capitalism catching up to basic logic. We didn’t solve the problem. We just stopped making it worse. And the companies? They’ll just raise prices on the next blockbuster. This is a band-aid on a hemorrhage.

Angel Fitzpatrick

February 13, 2026 AT 15:30They’re not biosimilars. They’re bioweapons. The FDA approved them without long-term immunogenicity data because they’re in bed with the pharmaceutical-industrial complex. You think the ‘interchangeable’ label is safe? It’s a Trojan horse. They’re testing these on millions of people without proper post-market surveillance. The real goal? To create a monoculture of biologics that can be controlled, tracked, and monetized through microchips embedded in the vials. You think that’s conspiracy? Check the 2021 FDA guidance on digital tracking for biologics. They’re already doing it. This isn’t about cost-it’s about control. And you’re all just drinking the Kool-Aid.